-

How to Create Your Own Cryptocurrency: Step-by-Step Guide

-

FinoTraze Crypto Bot Review: A Complete Guide to Automated Trading

-

Lost Coins and Crypto Black Holes: Where the Money Disappears

-

Cryptocurrency Mining: How It Works, What Can Be Mined, and the Profit-Loss Landscape

-

ZeonGrow Crypto Bot Review

-

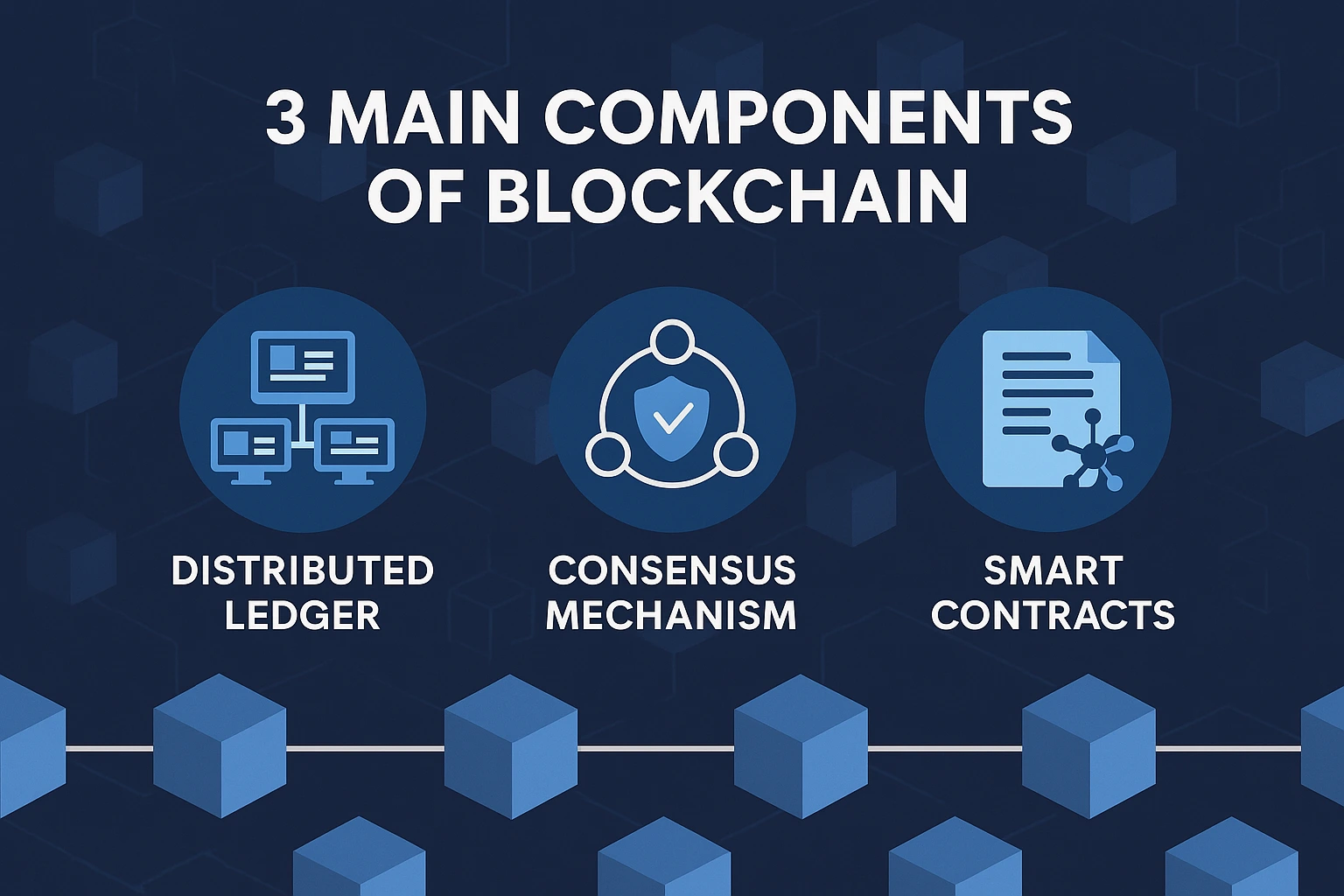

What Are the 3 Main Components of Blockchain?

-

Are Blockchain and Bitcoin the Same?

-

Can Blockchain Be Hacked? Security Explained

-

What Is X11 Mining? Complete Guide for 2025

-

How to Mine Bitcoin Cash: Complete Guide 2025